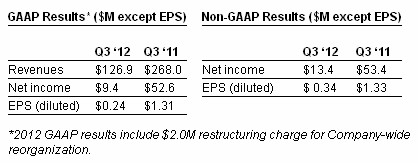

Veeco Instruments Inc. (Nasdaq: VECO) announced its financial results for the third quarter ended September 30, 2012. Veeco reports its results on a U.S. generally accepted accounting principles (“GAAP”) basis, and also provides results excluding certain items.

Third Quarter 2012 Results

John R. Peeler, Veeco’s Chairman and Chief Executive Officer, commented, “Veeco’s third quarter revenue was $127 million, and adjusted EBITA and non-GAAP earnings per share were $17 million and $0.34, in line with our guidance. Veeco generated $46 million in cash flow from operations, ending the quarter with $574 million in cash and short term investments.” Third quarter LED & Solar revenues were $94 million: approximately $79 million in MOCVD and $15 million in MBE. Data Storage revenues were $33 million.

Mr. Peeler continued, “Third quarter bookings were weak at $84 million, representing trough levels in all businesses. LED & Solar orders totaled $68 million: MOCVD continued to bump along the bottom at $63 million as LED customers work through overcapacity and delay significant fab expansions. MBE bookings declined 33% sequentially to $5 million, with customer consolidation causing a slowdown in production buys for wireless applications. Data Storage customers froze spending due to hard drive overcapacity and a weakening demand outlook, resulting in a 37% sequential decline in orders to $16 million.” Veeco’s book-to-bill ratio was 0.66 to 1 and quarter-end backlog was $187 million.

Fourth Quarter 2012 Guidance & Outlook

Veeco’s fourth quarter 2012 revenue is currently forecasted to be between $100 million and $115 million. Earnings per share are currently forecasted to be between ($0.09) to $0.03 on a GAAP basis, and $0.04 to $0.16 on a non-GAAP basis. Veeco is likely to take additional restructuring actions in the fourth quarter.

Mr. Peeler added, “Taking into account our fourth quarter guidance, Veeco’s 2012 revenue is forecasted to be over $500 million and we will have delivered double digit profitability, successfully managing through a challenging year.”

“We are cautious about short-term business conditions since there is still no clear sign that the economy is improving,” added Mr. Peeler. “However, the LED market is getting better – general lighting is growing, excess capacity is being absorbed, and customers are reporting more stable business conditions. An MOCVD order snap-back is inevitable as LEDs go from 5% of all lighting to over 30% over the next few years. Insatiable demand for storage will drive future hard drive industry capital expenditures and technology investments. We anticipate that Veeco’s orders will improve in the coming quarters.”

“In the meantime, we are focused on lowering our cost structure while protecting investments in R&D and new products,” concluded Mr. Peeler. “Our goal is to remain profitable while funding our future. We are market leaders with exceptional technology and customer roadmap alignment. We are well positioned for future growth as our end markets recover and the world adopts solid state lighting.”. www.ledtube5.com www.ledtubes8.com